Post expense journal invoice

This documentation will guide you through the process of posting for expenses as an invoice journal.

Requirements

To carry out this user guide, you must have the corresponding fields configured in the expense tab, Posting section (Setup expense for posting)

Process

Once the expense has been configured to be able to post, the process to follow for the posting of expenses as a journal invoice is detailed

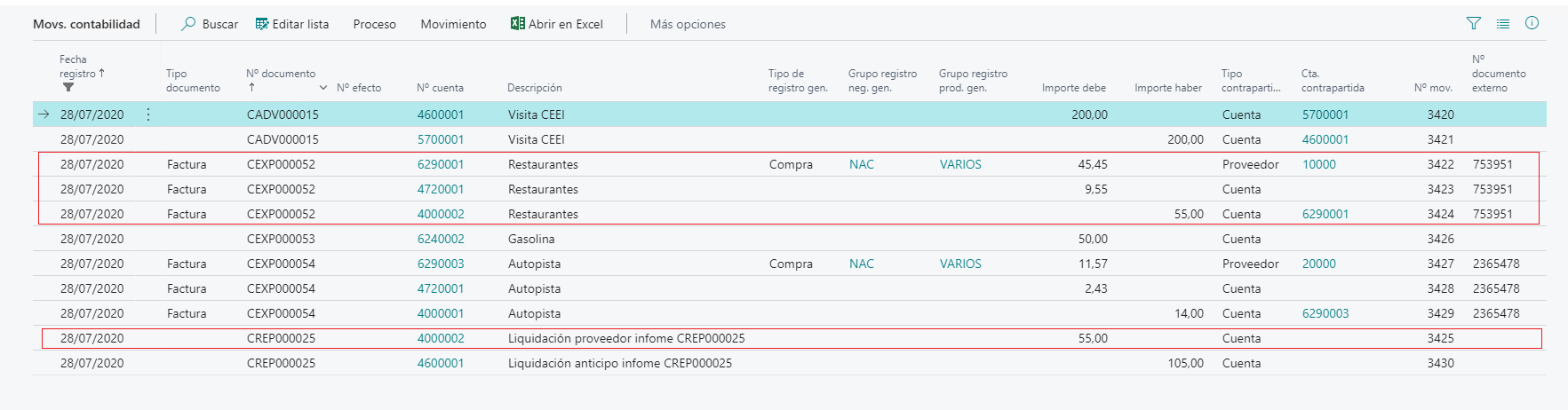

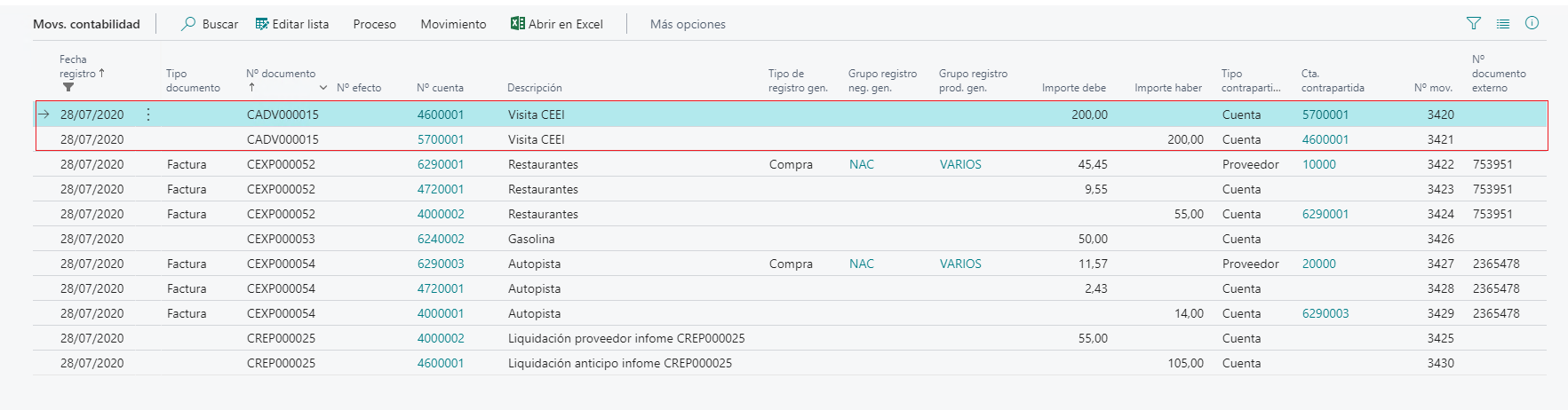

Posting reimbursable expense journal invoice

In reimbrusable expenses, the amount will be posted to the account no. that has the expense category associated, the Bal. Account type will be Vendor and the Bal. Account no. will be the vendor number. A journal line will be posting, settled the vendor's amount.

Warning

These two vendor movements mus be settled manually.

Info

If, when posting the reimbursable expenses, there is an advance related to the report and this advance is not posted to Business Central, the corresponding advance will be posted in the registration process.

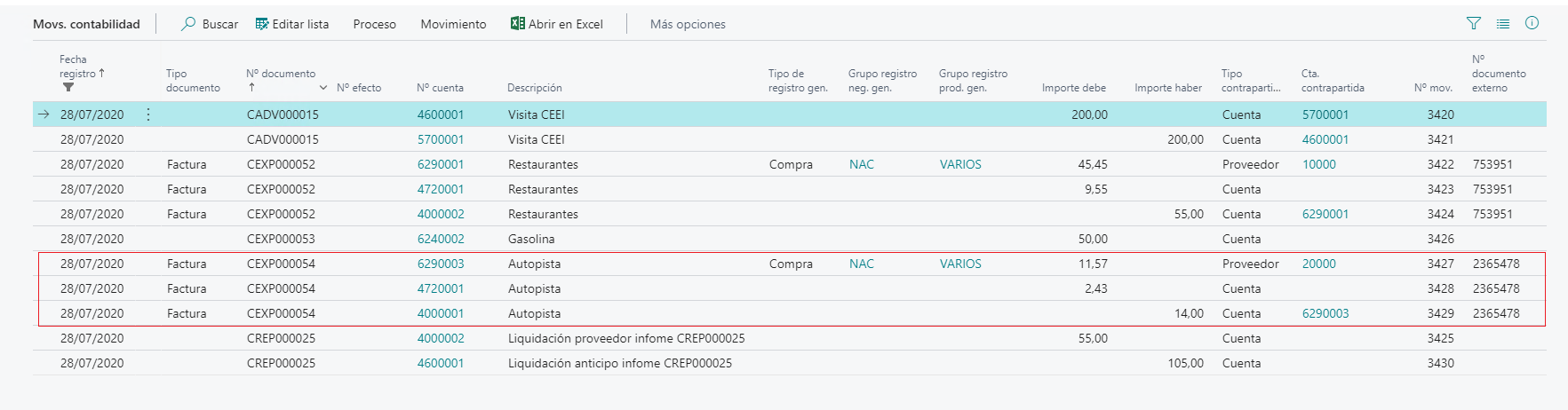

Posting no reimbursable expense journal invoice

In non-reimbursable expenses, the amount will be posted to the account number associated with the expense category, the Bal. Account type will be Vendor and the Bal. Account no. will be the vendor number. It will be settled by selecting the payment method corresponding to the payment method used.

Info

When all the expenses of the same report have been posted, both the report and the expenses of the report are automatically entered into the history.

Languages

This document is available in the following languages: